The Reserve Bank of Australia (RBA) has increased the official cash rate by 25 basis points, taking it to 4.35%. So just how much will this year’s Melbourne Cup day rate hike increase your monthly repayments?

Continue reading “RBA increases the cash rate by 25 basis points, up to 4.35%”Brokers help settle a record 7-in-10 new mortgages

Mortgage brokers have notched up a new personal best, with seven out of every 10 new mortgages settled thanks to their help! It’s a sure sign that mortgage brokers are delivering the goods when it comes to helping Australians move into their dream homes.

Continue reading “Brokers help settle a record 7-in-10 new mortgages”Revealed: the four cities tipped to be future property hotspots

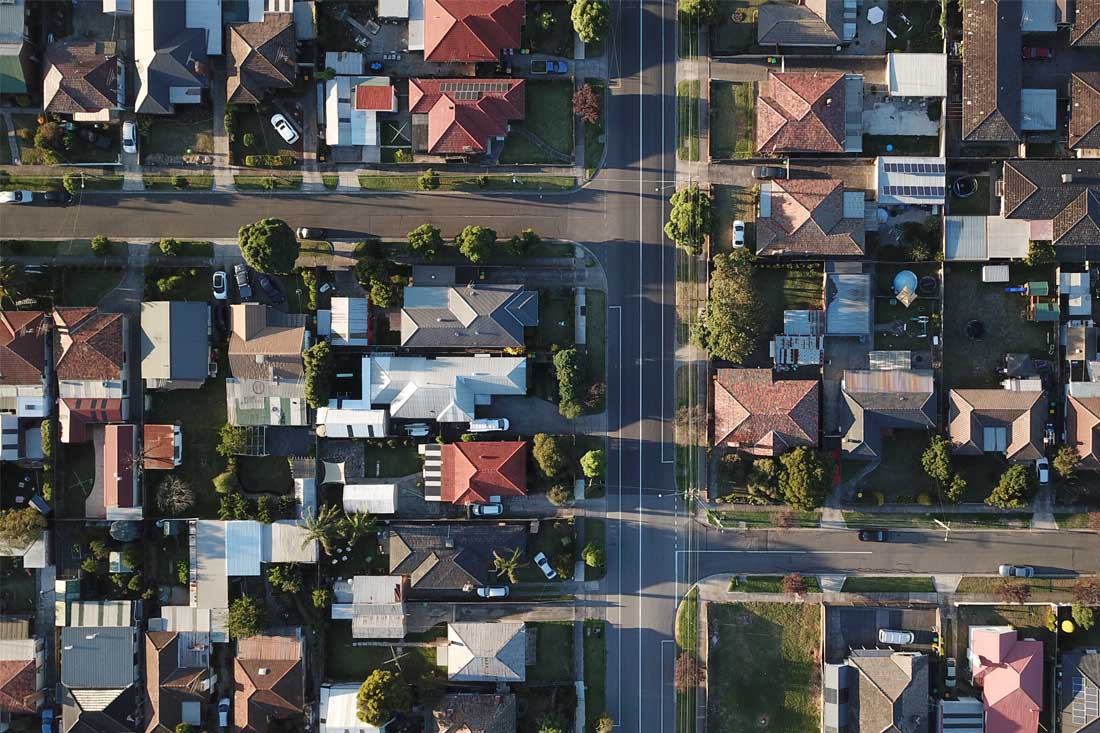

No matter whether you’re in the market for a home or an investment property, it makes financial sense to buy in an area where values are tipped to rise. But where to look? Today we’ll unveil the Australian cities where population growth is tipped to turbo-charge the property market.

Continue reading “Revealed: the four cities tipped to be future property hotspots”How much can you really save by refinancing?

Not sure what refinancing is all about? You’re not alone. Our quick explainer lets you master the basics and helps you work out how much you could save.

Continue reading “How much can you really save by refinancing?”One-in-three first home buyers use guarantee schemes

Know anyone who wants to buy their first home? A new report confirms that low deposit schemes are getting younger buyers into a place of their own sooner.

Continue reading “One-in-three first home buyers use guarantee schemes”The one big factor pushing house prices up

Property prices have soared almost 7% this year alone. With the upswing predicted to continue, we unpack what’s driving national housing values higher – and why it could pay to get into the market sooner.

Continue reading “The one big factor pushing house prices up”Flat chat: why units could soon become hot property

Apartments stand out as an affordable choice when it comes to cracking the property market, not to mention downsizing. But a looming shortage may soon push unit values higher.

Continue reading “Flat chat: why units could soon become hot property”3 ways pre-approval can give buyers an edge

There’s a lot to be said for having your home loan pre-approved. But does pre-approval mean you’re putting the cart before the horse? Definitely not. Here are three ways pre-approval can help you get ahead of the competition.

Here’s a handy tip: you don’t have to wait until you’ve found a home you’d like to buy before making mortgage enquiries with a lender.

It’s possible to have a home loan pre-approved before you’ve even started to wear out shoe leather at open home inspections.

It can mean you’re ready to go with your loan, with only a few formalities to sort out, as soon as you’ve found the right place.

Even better, pre-approval doesn’t mean you’re committed to taking out a loan. It’s not a problem if you have a change of plans.

Here are three ways home loan pre-approval can put you in front in today’s market.

1. Pre-approval gives you a budget to stick to

When it comes to a major step like buying a home, there’s no room for guesswork.

With a pre-approved home loan, you know exactly how much you can borrow, and that’s the foundation for your home-buying budget.

It means you can focus on homes within your price range, and make an offer with confidence.

Pre-approval is especially important if you plan to bid at auction. It sets a clear line in the sand for your highest bid.

2. You can act fast

In today’s market, homes are selling in turbo-charged timeframes.

Figures from CoreLogic show the median selling time across our capital cities is just 27 days. That’s less than a month!

So you need to act fast to avoid missing out. Sellers might not wait around while you head to the bank to see if you qualify for a home loan.

Having pre-approval in place means you can get the ball rolling as soon as you find the right home, without getting pipped by a more organised buyer.

3. Pre-approval can show you’re a serious buyer

Nothing says ‘genuine buyer’ like home loan pre-approval.

Don’t be shy about letting real estate agents know your loan is pre-approved. It adds clout to your negotiations and gives vendors confidence that you have the finance to follow up any offer you make.

Just consider keeping some information up your sleeve, such as how much you’ve been pre-approved for.

After all, the real estate agent’s goal is to get the best price for the vendor, not the buyer!

How reliable is pre-approval?

Home loan pre-approval is not a guarantee that you’ll get a home loan.

You won’t get the green light for sure until you’ve found a place to buy, and the bank has checked that the property meets their lending criteria.

Your lender will also want to see that your personal finances haven’t changed since your loan was pre-approved.

It’s also worth keeping in mind that while there aren’t many downsides to obtaining a single pre-approval, getting too many over a short period of time with multiple lenders can potentially negatively impact your credit score and ability to take out a loan – as lenders might suspect you’re financially unstable.

Which pre-approval is better?

Home buyers are often surprised to learn that pre-approval isn’t available with every lender.

Even among banks that do offer this service, not all pre-approvals work the same. One sort is especially worth aiming for.

You may come across two types of pre-approvals:

1. System-generated pre-approvals

This sort of pre-approval is generated by a lender’s computer based on the information you enter about yourself.

You can get a result quickly this way. The catch is that the analysis isn’t thorough, making the outcome unreliable.

In particular, if any of the details you enter are incorrect, the bank’s IT system may wrongly say you don’t qualify for a home loan.

2. Fully assessed pre-approvals

As the name suggests, this type of pre-approval involves your bank’s credit team taking a close look at your finances, credit score and other personal and financial details to be sure you can comfortably manage a home loan.

A full assessment takes more time, but it’s worth the wait. It can help you feel more confident that you’ll be offered a home loan when you find your ideal property.

Want to find out more about pre-approval?

If you’re looking to buy a home and want to get an edge over the competition (to put in an early offer, for example), then pre-approval might be a much-needed ace up your sleeve.

We can help you work out which lender and which loan product is a good fit for your pre-approval situation.

So call us today to take the guesswork out of home loan pre-approval, and give yourself a head start over other buyers in the market.

Disclaimer: The content of this article is general in nature and is presented for informative purposes. It is not intended to constitute tax or financial advice, whether general or personal nor is it intended to imply any recommendation or opinion about a financial product. It does not take into consideration your personal situation and may not be relevant to circumstances. Before taking any action, consider your own particular circumstances and seek professional advice. This content is protected by copyright laws and various other intellectual property laws. It is not to be modified, reproduced or republished without prior written consent.

Property market climbs towards new peak

The property market has thumbed its nose at higher interest rates, with values rising almost 5% since March. Here’s why national housing prices are climbing higher.

Continue reading “Property market climbs towards new peak”How does your home loan compare?

No change to the cash rate again this month, but lenders’ mortgage rates have been jumping around more than a bunch of toddlers at a Wiggles concert. We reveal the current average rates to see how your loan compares.

Continue reading “How does your home loan compare?”